The UCI has published its annual report and accounts for 2015 on its website. It’s full of glossy images but let’s skip to the numbers at the back to see how the governing body is earning and spending its money.

This is the 2015 report so it covers everything up to the end of last year and it uses the future tense to talk about 2016, for example “The UCI Women’s WorldTour will be promoted by a strong brand identity used on all organisers’ communication materials”. All numbers are in Swiss Francs (CHF). On 31 December 2015: CHF 100 = US$100 = €92 = £67.

The exchange rate matters to the UCI because in 2015 the Swiss franc soared in value and this was bad for the UCI which earns income in other currencies like the Euro. So several big income items suddenly became 20% less valuable when converted into Swiss francs as displayed in the accounts. It meant the UCI made a loss on the year, and this despite not having to fork out for the CIRC Report as it did in the prior year.

The UCI is not a business but a non-profit body which gives it considerable perks under Swiss law, it’s one reason many sports governing bodies are based in Switzerland. Any surplus generated during the year is not paid out but retained and this time the loss is covered by the UCI’s reserves.

- Revenue for 2015 was CHF 34 million, down from CHF 36 million the previous year. It’s worth remembering this sum as it’s in the same ball park as a top pro team. Of course the comparison between a governing body and a team is odd but it helps illustrate the relative size of things

- The UCI’s single biggest income item is “hosting fees” for which it collected CHF 9.1 million in 2015, largely from the road cycling world championships in Richmond but the track and cyclo-cross worlds make meaningful contributions here

- There was a big drop in “fines and penalties” from CHF 976,000 to CHF 333,000. This isn’t because the peloton has got better at littering and peeing in public, instead it’s because there have been fewer big name doping busts which impose a hefty fine on the culprit

As a whole all the UCI World Championships brought in CHF 16.549 million meaning almost half of the UCI’s revenue comes from competitions to award those rainbow jerseys and, making an assumption or two, about CHF 10 million of this comes from the road cycling worlds. This means the Worlds is crucial to the UCI. There used to be a special rule that a rider who was under investigation for anti-doping could not start the Worlds to “preserve the serenity” of the event but this was dropped last December, presumably because if a rider is eligible to ride, say, the Vuelta a España then they can ride the Worlds too.

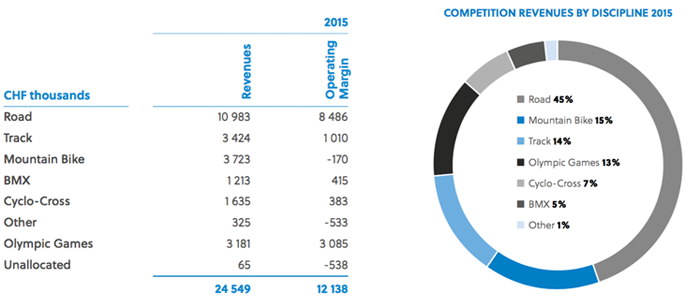

Here’s the UCI split of income and margins per discipline:

Road accounts for 45% of the UCI’s revenue and 70% of its operating result, in plain terms the UCI is big into road racing and makes most of its money from this. How? Largely thanks to the annual Road World Championships and the impressive host city fee, TV rights and sponsorship income generated by this week. Cyclocross saw a big jump in revenue while mountain biking runs at a loss again.

You might wonder how the UCI makes CHF 3.1 million from the Olympics during a non-Olympic year and the answer is that International Olympic Committee (IOC) awards the UCI a large pot of money which the UCI spreads out over each of the four years of the Olympic cycle. This raises the interesting matter whereby the UCI derives most of its legitimacy as the Olympic governing body recognised by the IOC but gets most of its income from pro road racing which means a tension: the UCI exists because of the Olympics, it runs because of pro cycling.

Some other snippets among the accounts:

- The demise of the Tour of Beijing has dented the accounts. After the exchange rate fluctuations the ending of the contract with the Chinese authorities appears to be the single biggest hit to the UCI’s income in 2014 (it’s said one reason the race was dropped was because the Chinese learned how much more they were paying than anyone else).

- The World Cycling Centre is the velodrome and the development programme. It costs about two million Swiss francs a year

- There’s a restaurant inside the World Cycling Centre that turns over more than a million Swiss francs a year and makes a small profit, notable because it accounts for 3.5% of the UCI’s annual revenue

- The UCI pays CHF 1.1 million to the Cycling Anti-Doping Foundation, its arm’s length anti-doping body

- Brian Cookson’s salary rose by 2% to CHF 351,000

- The UCI employs 111 people. Of the full-time staff, 42 are women and 57 men

- The employee headcount went up from 108 to 111 while the wage bill jumped from CHF 11 million to CHF 12 million, a significant rise

- The UCI ended the year with CHF 7.6 million in cash, down from CHF 12 million. It’s not much of a buffer for future years but the Olympics should help

- The aim is to build a CHF 20 million reserve fund “to act as a reserve to ensure the UCI’s continuing operations for a minimum two years in the face of a catastrophic event” which is not specified

- There’s no split between the amount spent on men’s cycling and women’s cycling. In 2014 CHF 240,000 was allocated to “Women’s Professional Cycling Support” while investment in this in 2015 was out of the general budget

- The UCI has 185 national federations, 1,500 registered pro cyclists and 500,000 licensed competitors. Maybe you’re one of them?

UCI World Tour

Now onto the World Tour. The UCI gives accounts for it but the funding is controlled by a committee called the Professional Cycling Council which includes the UCI but also the teams, riders associations, race organisers and others. Here is the income statement for 2015:

As you can see the teams pay in CHF 1.4 million in licence fees which works out at around CHF 80,000 per World Tour team.

One regular refrain on social media is that the UCI doesn’t want to do such-and-such because it makes so much money from pro racing. For example the allegation that the UCI didn’t want to rip up Astana’s licence last year because it would lose all that lucre from Kazakhstan. Only as the accounts show the World Tour is small in revenue terms and there are many costs involved. A licence fee from a team is income but there are costs to set against this like auditing the team’s finances and so on. A big jump in team audit and assessment costs put the World Tour accounts into the red for the year.

Conclusion

The report is a reminder that the UCI is about more than road cycling with sports like indoor cycling and BMX featuring. It’s a good resource full of stats on competition and more, for example there are more than 500 velodromes and 750 BMX tracks around the world but the above walks readers through the money but if you want all these stats, see the report for yourself.

In terms of finance 2015 was similar to 2014 and that’s what we’d expect from a governing body which has annual income from world championships and repeat income from fees and sponsorship. This is not going to fluctuate too much. But the Swiss franc’s rise meant earnings in Euros and Dollars fell causing a hit to the accounts and the Tour of Beijing’s demise added to this while hidden in the accounts we see the wage bill jumping by a million too, all causing a significant shortfall in 2015. As ever it’s the Worlds not the World Tour that generates the most money for the UCI.

Exchange rate on 31 December 2015 CHF 100 = US$100 = €92 = £67.

Not a bad earner Brian!!

Holy mackerel! You’ve just got to laugh. I doubt he was making 20% of that at his day job before he was elected. And the guy hid so well, he didn’t even have a CV.

We are entering an era of corruption across the world that beggars belief.

He’s on significantly less than your friend Pat McQuaid 😉

Pat worked for it. And had been accomplished.

I’d smiley face you back, but I don’t know how.

Zing!

It is a lot of money to take from what is effectively a medium sized business – he takes 1% of its entire income.

Inner Ring …. he reads the boring stuff, so we don’t have to.

Many thanks, seriously, I don’t know how you find the time.

Keep up the good work.

That was going to be a line in the piece above: “I’ve read it so you don’t have to” but it got deleted.

Absolutely. That was a very interesting read, but no way would I be reading the original document. Inrng, you are our hero(ine).

As an aside, I quite like that we don’t know who you are or anything about you. The opposite of an anonymous troller, you are an anonymous bringer of joy.

Echo all of these sentiments. Thanks INRNG

Thanks. But a “bringer of joy” for commenting on a sports body’s annual report and accounts? Some people are easily pleased 😉

Now that surely has to be one of the t-shirts – “I read the boring stuff so you don’t have to” – “Inrng”

I’d definitely have one of those!

Ah, but I’m a man of science by trade, a bit geeky and interested in numbers. Then you come along, do the boring bits and present us with the nuggets. Superb!

And the most measured and nuanced analysis of the actual bike racing that I’ve come across on the web. Marvellous!

OK I’ll stop the love-in now, thanks.

I’d add that as well as your anonymity INRNG, you appear incredibly even-handed, which is part of the reason why the below the line debate remains (mostly) polite, and hence readable…

Yes I am one of those licensed competitors.

However I get don’t get anything more than adding to the bottom line of BC, Surrey Leauge, and UCI for the pleaure.

C’mon – you pay for your license, and compete under a framework that has a clear(-ish) set of rules, with a governing body that works with WADA to go after dopers much stronger than any other sport on the planet. You get insurance coverage over your events, commissaires who are trained and for the most part are fair and even handed. You get a races put on by organisers that don’t have to invent their own set of rules because the UCI already made the rules. Of course it isn’t perfect, but it is definitely better than it was and better than it could be.

Of course you might not get obvious tangible benefits from your license fee, but you can’t say you get nothing.

Inrng wrote :

“The UCI is not a business but a non-profit body which gives it considerable perks under Swiss law like tax free salaries for staff and generous loan terms…..Any surplus generated during the year is not paid out but retained and this time the loss is covered by the UCI’s reserves.” and then this…..”The aim is to build a CHF 20 million reserve fund”.

Even if it were a non-profit, and considering that all ‘profit’ is not necessarily monetary in nature and therefore the term ‘non-profit’ is a contradiction, which it is clearly not, why should those it employs pay no tax ? Do they not have the opportunity to use the same ‘public’ goods as some others who do pay taxes ? or is every road in Switzerland a toll road ? Do you pay taxes Inrng ? The riders pay taxes do they not ?

The IOC, UCI and similar organizations are a fraud.

“which gives it considerable perks under Swiss law like tax free salaries for staff and generous loan terms”

…must admit this is something I did not know.

I’d guess that Inrng is talking about employer taxes, to be paid on top of the salary but not touched by the employee, rather than income tax. Otherwise it does seem too good to be true.

I’m not a tax expert but the employees do pay tax, it’s just the employer, the UCI, as a registered charitable association, gets exemptions on some of the employer/payroll taxes. There might be some VAT benefits too. The sports governing bodies qualify for this but the original purpose of the law seems to have been NGOs and bodies related to the League of Nations and then the United Nations.

I would have thought that the UCI is set up as a verein – a ‘Verein’, or association, under swiss law doesn’t pay tax – the law is primarily aimed at local community sports, music, etc clubs and many Swiss people are members of one or more. Many of the non-dividend paying sports management organisations (‘profit’ being dubious when you’re talking about FIFA) use the verein form of organisation and get the same tax benefits as your local cycling club or brass band. There was a push for the likes of FIFA to change after some of its recent record revenues. They did have to pay some tax but remain a verein.

EXACTLY – Inrng is correct: ALL employees do pay tax on their salaries.

The UCI is a non-profit, and as Inrng mentioned, the profits stay in the organisation, and therefore do not get distributed to shareholders and therefore the UCI DOES NOT PAY TAX ON PROFITS. The money going to a reserve fund is to help fund future years that may have a deficit. This is a common way to run charities and non-profits throughout the world.

I can confirm this, a reader from Aigle says UCI staff pay taxes on their salaries. I’ll go and edit it above.

Switzerland, a tax haven? Surely not!

L’étranger – to clarify, Inrng is correct that the UCI does not pay INCOME tax on excess income (or profits). However, if the UCI owns any land, it is NOT exempt from paying property tax, and property tax is the tax that covers road fees, infrastructure projects, etc. for any municipality.

As Inrng suggested, being exempt from income tax is the most significant of the taxes, and consequently for all non-profits and charities, it is the largest benefit of their charity status.

Perth(Australia) wil host the UCI masters final this year – now called the Granfondo World Series (GFWC). Any idea if the city is paying a fee to the UCI for this privilege?

Wow, interesting stuff. Is there any rhyme or reason why the road worlds costs the UCI ‘just’ CHF 2,497 against the CHF 3,893 for the loss making MTB worlds? Seems an incongruous disparity at first glance but does the UCI assume most of the costs for MTB as opposed to Richmond absorbing cost as well as paying for the event?

There’s not much cost for the road worlds to the UCI as most of this falls on the host city. As for the MTB worlds it’s not obvious, maybe they pay for the TV production rather than sell the rights?

The “catastrophic event” always used to be listed in the accounts as a cancelled road worlds and/or an OG that didn’t generate substantial revenue.

With the aim being reserves kept the organisation viable in the event of either/both

Thanks, I did have in mind some kind of litigation risk, eg they stop a big name rider because of his blood data or even a whole team and this is then overturned in the courts and massive damages are awarded.