Tax is a big topic in France right now. With a promise to cut its budget deficit, the French government has been looking for ways to raise extra revenue. Meanwhile unemployment is high and many agonize over the long-standing high payroll taxes that make hiring expensive.

Beyond the newspaper front page or the business section, the saga of football club AS Monaco’s promotion to the top league of French football has put the spotlight on zero-tax Monaco vs high-tax France. It’s also a big issue behind the scenes in cycling. If it’s not a talking topic, high payroll taxes in France are fundamental to understanding why French teams face an uphill task compared to their rivals.

Definition

Let’s start with the basics. A payroll tax is a tax paid by the employer based on the employee’s wages. You might think of workers in a factory here but it applies to a pro team which pays the same tax on a percentage of a rider’s salary.

Oh la la

France which has some of the highest payroll taxes in the world and by some measures the highest. The rates vary with sliding scales, deductions and other variables that help keep accountants and payroll software vendors in clover. But the number is about 42%, knock yourself out with the OECD report. It means to pay a rider the UCI minimum wage in the World Tour of €36,300 a French team pays €51,500: €36k in salary plus about 40% or €15k in tax. Once the rider receives the money they they’re liable for income tax and social security contributions.

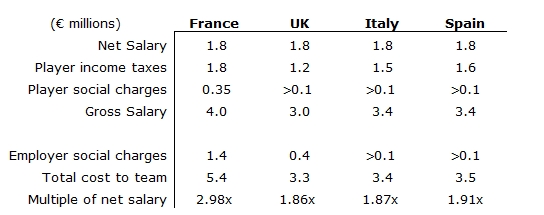

The upshot is that a French team has to pay more in tax to hire a rider than a Spanish, Australian or Dutch team. Substantially so. It’s a subject that’s interested the French senate who looked into the matter with regards to football. Here’s some data on the effect of taxes when a soccer club looks at hiring a top player:

To explain the table, we start with an athlete and his agent saying “pay me €1.8 million a year”, a salary you might expect for a rider capable of winning a grand tour. The athlete can pick from a range of teams in different countries but wants to be paid this amount. In lines 2 and 3, the rider or footballer has income and payroll taxes to settle themselves but already these are significantly greater in France, the gross budget needed to be set aside is €4 million compared to €3-3.4 million for neighbouring countries. Our exemplar rider might move to Monaco, where no income tax is liable. The move will save them well over a million Euros a year.

But here’s the rub: then come the payroll taxes, the social security charges. In France these are massively higher, see line 5. On the gross salary of €4m, another €1.4m in charges are added, meaning a French team needs to budget €5.4m just to ensure a rider gets his €1.8m, whereas a British-registered team only needs to spend €3.3m to meet the rider’s demands. This isn’t an abstract matter, take the case of Sylvain Chavanel who had been of interest to several French teams but he went to Swiss team IAM which might have a smaller budget but it can stretch it further.

Golden generation, golden pay?

Look to the future and the current crop of riders is very promising. But if they deliver then they’ll want to be paid accordingly and if a non-French team offers a high salary then it’s possible the French squad cannot match it and the rider would leave abroad. Should they stay then it would take an exceptional commitment from the sponsor.

Teams can move. At the stroke of a pen it’s possible to reclassify a team and. “Italian” teams Vini Fantini and Bardiani-CSF have their headquarters in London and Dublin respectively. Kazakh outfit Astana are run through Luxembourg. French teams could move their tax domicile to another country. But they can’t:

- FDJ is state-owned and this would not be allowed

- Ag2r is a health-insurance company that trades on values of solidarité that exclude moving a cycling team to Ireland

- Europcar is a big French company and the team has deep roots in the Vendée region whose regional government has kept the team afloat over the years

- Smaller team Bretagne-Séché are also sponsored by a region, they cannot move abroad

- Cofidis could consider the move but if it wants a wildcard invitation to the Tour de France then being seen to be French is the best way to get invited

Home Advantage

In fact paying high taxes in France is a way to buy yourself a start in the Tour de France. It is expensive but you can be sure of the golden ticket for July. Teams like Cofidis and Sojasun have been able to ride the Tour de France when, if they were Turkish or Brazilian, would have slim chances of being selected. For all the penalty of being French on the tax side, being French is very valuable for some teams on the sporting balance sheet.

There are other advantages too. There’s talk of a “golden generation” right now in French cycling but it’s not thanks to luck. French cycling has deep roots with a large network of clubs and teams to act as talent scouts. Those high taxes fund coaches and a strong U-23 programme, so much that the UCI has removed the international status of some French U-23 because the French simply had too many events.

Conclusion

Mercifully cycling is a sport and there are greater factors to success that the tax rate applied to a team. But whether it’s hiring a neo-pro or signing a superstar, it costs more in France to pay riders and this is a contributing factor to the relative weakness of French squads. People used to talk about a two-speed cycling in relation to doping, relatively clean French squads up against some foreign squads with a less ethical stance. But given the tax differences we also have un cyclisme à taux variable and as the current crop of French riders progress it’ll be interesting to see if they remain in France.

- I’d covered the topic once before but readership has grown by a factor of beaucoup so it’s time to revisit, update and reflect again on the subject. Also if you have an iPad or iPhone, subscribe to 2r Magazine for a recent article on Italian teams who are secretly registered in low-tax locations like London and Dublin.

The “case” Chavanel has more reasons than one would imagine. Besides financial ones, the other two of them are: He wants to be an undisputed leader, but this was not achievable in Omega. So he decided to be “first in Gaul than second in Rome” :). This is not so rare, e. g. Konig still stays with NetApp. The second (closely conected but not very public) reason was that at TdF Sylvain did not work for the teammate Kwiatkowski and his white jersey even if directly asked by the OPQS management to do so. Transfer to IAM solved these issues.

Hi Inrng,

I don’t understand the reason of UCI removing the international status of those U23 events you mentioned. Can you explain it?

Thx

There have been too many U-23 races in France, the UCI wants to share them out with other countries.

Just to help me understand

didn’t someone say recently that the riders were subcontractors, in essence self-employed?

This happens with many teams but it’s not allowed in France. It’s a further saving for other teams, they must pay a rider their salary plus more to cover social security charges/self-employment payroll taxes on top but it puts the risk on the rider and often it costs less, there is no pension contribution.

Yes, in some countries you can do that, in France, you can not.

Thank you inrng, as a relatively new rider it would be great to have a few more picks from the archive over the close season, assuming you are not taking a well earned break!

With inrng (as the saying goes) it’s all hit and no sh*t. 🙂

As a starter for the close season, have a look at the series on European Foods. Enjoy.

http://inrng.com/2010/10/euro-food-part-i-nutella/

There are loopholes (although I am not aware of French employment law)!! The issue with the Shlecks surfaced last year when they were not paid on time.. The team can pay the riders low salaries and then pay their marketing / promotion companies fees to offshore accounts..

In the 80-ties eastern (communist-led) countries let olders sportsmen go west and earn desired western currency. But they had to bring it home and it was converted to local money in bad rate. That lead to what you mention – low salaries plus some inofficial income.

It will be interesting to observe whether some top french cyclist becomes Depardieu-type renegade.

Someone joked: There would be no tax h(e)avens if there were no tax hells.

As you probably know some riders were even “sold” for Western currency for the Sovintersport agency, sending ice hockey players to Canada for cash and the same with cyclists into the Alfa Lum team.

Luxembourg is the home of “image rights” contracts

http://inrng.com/2011/09/image-rights/

and this is 100% legal as if you are taxed in one EU country on a certain income or asset you cannot be taxed again in another EU country!!

My understanding is there are no Italian teams registered in Ireland anymore as Cycling Ireland introduced a fee of €10k for same and the teams moved. In 2012, the only team registered in ireland was Polygon (continental team made with 5 Irish cyclists)

the french social charges also pay alot for being unemployed – chomage. So a rider could be out of a contract and receive for the next two years a very high % of his wages.. and not ride. Better that than to take a pay cut, and ride! especially when fewer teams. Tax is affecting other (non-french) teams too

Presumably the “problem” has the potential to be the the same for any team that hires a French rider domiciled in France for tax purposes – and equally there will be limited exclusions for non-French riders on French teams not domiciled in France for tax purposes (with a whole raft of EU laws coming into effect etc)

(With one of the main differences between football and cycling being that members of a team are a lot more likely to be spread over the globe rather than live within reasonable proximity of the football stadium for 6+ months a year)

There are some differences here, yes. A French rider cannot escape taxes by moving to Monaco to join Gilbert, Boonen, Gerrans, Hushovd, Pozzato, Froome etc but several sports stars do live in Switzerland for this; as do the likes of Nibali, Contador etc.

It is noticeable that the overwhelming majority of French riders ride for French teams. There are no doubt many many reasons for that other than tax – but does cause pause for thought that if they remain “French” for tax purposes whether the obligations of the French tax and social security system weigh against them in the transfer market.

Thinking about the Sky approach where there seem to be no employees as such, then would it cost Sky more to ensure equal pay between two riders one based in France and one based in UK? And vice versa. If FDJ wanted to hire Wiggins, then if he remains UK resident for tax, self employed and conducts most of his business outside of France, then do the reciprocal arrangements in place mean he costs FDJ the same as he would cost Sky?

French riders have a good home base, many cultural reasons rather than tax. But team managers do talk about the tax issue as a problem they face. With Wiggins and FDJ, it’s the self-employment/contractor part that is probably out of the question.

Seems like this is a fairly recent development? When the big money started flowing into the sport around the LeMond/Tapie era, a lot of things changed….not all of them to the good. The socialist in me thinks there should be a way to prevent companies and individuals from setting up in a place solely for tax purposes while conducting their business and living elsewhere.

The big money probably changed things but I suspect things changed over time, riders would earn most of their money from doing criteriums and other crowd-pulling events and go home with bags of cash, presumably some didn’t declare every last franc and lira.

Some countries do have tax laws meant to stop this. However, other countries have tax laws which encourage it, so companies set up in those countries (Luxembourg, Bermuda, Delaware, etc)

If the UCI were not so dysfunctional, here’s a possible solution. Make all Pro Tour riders employees of the UCI, which is based in Switzerland. Each team would contract with the UCI for the services of its riders (with each rider agreeing to the conditions offered). Riders would still be bound by their own country’s tax rules for working for a Swiss company, but at least it wouldn’t matter as much where the team was based.

Some pretty immediate problems with European law there. (Even though Switzerland is outside the EU, loads of the race venues are inside it.)

Irrespective of the perception of the UCI, to have a set-up whereby some of its competitors in a particular branch of the sport – any branch – are employees of the sports governing body, is total conflict of interest.

And look at rugby, where the french budgets strech the furthest in the world!

Their budgets don’t stretch further. They are simply so much wealther than the celtic/italian teams and aren’t hamstrung by salary caps in the same way as the english clubs. In short, their relative wealth is great enough to counter the sort of disadvantages faced by french cycling teams.

Thank you for this interesting article. As there’s a tax convention between France and Monaco French riders can’t avoid taxes over there. The French tax exilees rather go to Switzerland like Jalabert,

Virenque or Moreau in the past.

Only they went to the high tax cantons of Switzerland. I think the French anti-doping response after Festina played a part, the same as Armstrong moving to Girona.

Basic question: why so they tax jobs so heavily in France? Is this why unemployment is so high?

CJ, you run the risk of turning our host’s lovely cycling blog into a political flamefest…

There are dozens of explanations for European unemployment. Those on the political right would probably point primarily to high taxes, inflexible labour laws, relatively generous unemployment benefits. Those on the political left would likely point first to the overly tight interest rate and fiscal policies imposed on Europe by the ECB – to a substantial extent, Germany throwing its weight around to impose its paranoia about inflation on the rest of Europe when unemployment is a much bigger problem.

A more fundamental and longer-term problem is that the Eurozone imposes a common interest rate policy and currency value across disparate economies, without fiscal transfers of the scale needed to make that viable (look at the United States, where richer states like California and New York transfer huge amounts of tax revenue to places like Alabama). If Greece still had the drachma, Italy the lira, and France the franc (and so on), they would have devalued dramatically against the Deutschemark, Swiss franc, and to some extent the British pound, and those countries would have suddenly become much cheaper places to export stuff from (or visit as a tourist) without the pain of nominal wage cuts.

Hopefully that was even-handed enough to not start a flamefest.

French payroll taxes are long-standing and don’t have too much to do with currencies. It is strange to the outsider that jobs are taxed high but as many things are taxed a lot in France, it’s not jobs that are singled out for heavy taxes. People working they pay taxes with added social security charges on top. One reason they are high is because of all the benefits paid back, as atelier points out above, if you lose your job in France then you get a couple of years of unemployment insurance paid by the state at a percentage of your previous salary. So a pro rider who is on a folding team and has been on €150,000 might be incentivized to take unemployment for two years at €80,000 a year rather than sign for a new team at the UCI minimum of €40k. But this is simplified, unemployment payments vary, they’re subject to some taxes and more so the figures are ballpark rather than precise.

Really basic question regards the table –

we start with an athlete and his agent saying “pay me €1.8 million a year”………. In lines 2 and 3, the rider or footballer has income and payroll taxes to settle themselves but already these are significantly greater in France, the gross salary for an athlete in France needs to receive is €4 million compared to €3-3.4 million for neighbouring countries. Our exemplar rider might move to Monaco, where no income tax is liable.

Does that mean when we hear about a rider being paid £250k or £2million these are all take home and not gross figures?? ie figures in the media – these figures are all irrespective of taxes…..

Good question and it’s not basic. The answer is a lot more complicated too as it varies although as a whole the sum in the media is the gross number; many riders move to Monaco (Froome, Gilbert, Boonen, Hushovd etc), Switzerland (Nibali, Contador) or Andorra (Rodriguez, Cam Meyer) to pay less tax.

But the bigger the deal, the smaller the salary component, there are bonuses, payments for image rights and all sorts of other variable components that aren’t salary. By contrast a rider on the UCI minimum wage receives their salary and the figure is gross, they must meet taxes.